Taxsoftware.com 2290 Highway Taxes for iPad

For unlimited free support please e-mail to [email protected]

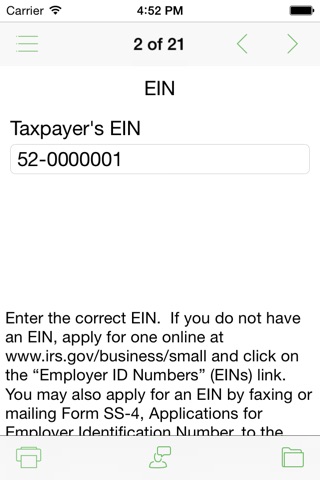

Have to pay Heavy Highway Vehicle Use Tax with form 2290? It’s Easy. You can do it on the iPhone or iPad with Taxsoftware.com’s app for Form 2290. Once you e-file, you receive a copy of your IRS stamped Schedule 1 by e-mail, almost instantly.

1. On the very first screen, just start by entering your company’s name and your e-mail address. Then click on NEXT.

2. Enter your company’s full address. Click on NEXT.

3. Enter information about the officer signing the return. This is mandatory. Then click on NEXT.

4. Select the date placed in service. This filing is for tax year 2015, which covers dates between July 1, 2015, and June 30, 2016. You can file for annual or partial year. Whichever way you need it. Click on NEXT.

5. Enter the VINs and the weight of the vehicles you are paying taxes on. The app will figure out the category. This app can handle up to 2 vehicles in the same filing. Just keep click on NEXT to enter the next VIN.

6. Do the same procedure to enter suspended VINs (category W). Suspended vehicles are the ones that were used on public highways 5,000 miles or less, or 7,500 miles or less if an agricultural vehicle. You can also suspend vehicles that you sold, or put out of service. You can enter up to 10 vehicles in the same filing. Just keep click on NEXT to enter the next VIN.

7. You can take credits for vehicles sold or placed out of service. Make sure to enter an explanation and the date you took the vehicle out of service. Calculate the amount of credit and click on NEXT. Just keep click on NEXT to enter the next VIN for credit.

8. This app figures out how much taxes you owe and gives you your balance due. Click on NEXT.

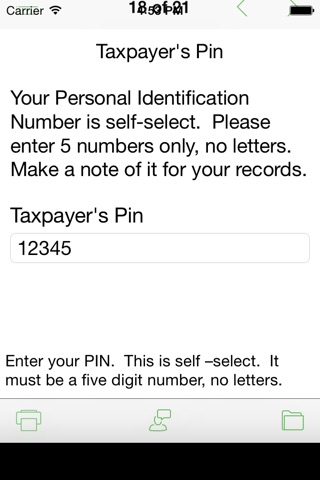

9. Enter a PIN to e-file. Make sure it is a 5 digit numerical only PIN, with no letters. Click on NEXT.

10. You can pay your taxes due by ACH, EFTPS, or check. Just select the method you want to use then click on NEXT.

11. Enter information about the person entering data on the app. Click on NEXT.

12. Click on PREVIEW. It lets you take a pick of the return before you e-file. Click on PREVIEW again to go back to the previous screen.

13. Click on the E-FILE button when you get to the last page. Then click on CONFIRM SEND.

14. You will receive an IRS stamped Schedule 1via e-mail after you e-file.

Taxsoftware.com is online. This means you dont have to go to the store to buy your product. You simply download it whenever you need it. You dont have to wait for the company to mail you the latest updates. Just download them, instantly! This also makes the software less expensive than our competitors.